Licensing Information

Apply for a Real Estate License

Please select the license type you are applying for:

To become a licensed Sales Agent an individual must:

-

Meet the statutory licensing qualifications of honesty, integrity, truthfulness, reputation, and competency. (Utah Code Annotated 61-2f -203(1)(c)).

Note: Administrative Rule R162-2f-201, provides additional detail about how an applicant’s criminal history and other relevant factors affect the applicant’s qualification for licensure, see R162-2f-201(1) and R162-2f-201(2). - Be at least 18 years of age at the time of application.

- Have at a minimum a High School diploma or its equivalent.

- Take 120 hours of approved education at a certified Real Estate Pre-License School as outlined in the Real Estate Pre-License Education Curriculum . This education must be completed no longer than one year before applying for a license.

- Take and pass the Sales Agent exam. A license request must be made within 90 days of passing the exam.

-

Submit application to the Division. The checklist will help you provide a complete application and must be included with the following documents:

All documents must be in PDF format before uploading them to the EGOV website.

Need help converting your files to PDF? Please click here.- Checklist

- SALES PERSON APPLICATION – Original, completed, signed and dated document issued by the Pearson VUE testing center (Sales Person Application - Page 1).

- QUALIFYING QUESTIONNAIRE – Original, signed and dated responses to document issued at the Pearson VUE testing center, and all supporting documentation requested for any “Yes” answers (Sales Person Application - Page 2

-

UTAH DIVISION OF REAL ESTATE – CONSENT TO BACKGROUND CHECK (4 pages) – Original, signed and dated document issued at the Pearson VUE testing center.

PLEASE NOTE: Fingerprints are now required. Fingerprinting services are being performed at Pearson VUE (However ONLY FOR THOSE WHO HAVE MADE ADVANCE FINGERPRINTING APPOINTMENTS. Private fingerprinting service vendors can also be utilized to perform fingerprinting for those who did not have their fingerprints taken at Pearson VUE ((2) blue FD-258 FBI fingerprint cards).

- CERTIFICATION OF LEGAL PRESENCE – Original, completed, signed and dated document issued by the Pearson VUE testing center. (No license number is required for new sales agent applications)

- CANDIDATE EDUCATION CERTIFYING DOCUMENT – Original, signed and dated document issued by the real estate school, (this document is only valid for one year and must be submitted within 90 days of passing the exam), or valid education waiver issued by the Division of Real Estate.

-

NON-REFUNDABLE FEE – $157.00 ($100 application fee, $12 recovery fund fee, $40 fingerprint processing fee, and $5 FBI RAPBACK enrollment fee)

Note: Incomplete applications will be returned to the applicant.

Note: If the exam is taken at a location in Utah, fingerprints will be taken after the exam. If the test is taken outside of Utah, fingerprint cards can be obtained from the Division or a local police station.

To become a licensed Broker an individual must:

- Meet the statutory licensing qualifications of honesty, integrity, truthfulness, reputation, and competency. (Utah Code Annotated 61-2f)

Note: Administrative Rules R162-2f-201, provides additional detail about how an applicant’s criminal history and other relevant factors affect the applicant’s qualification for licensure, see R162-2f-201(1) and R162-2f-201(2). - Within the past five-year period (preceding the date of application), have three years full-time, licensed, active real estate experience; or two years full-time, licensed, active, real estate experience and one year full-time professional real estate experience from the optional experience table 3 in the Appendix of Administrative Rule R162-2f-202b.

- Within the five-year period (preceding the date of application), accumulate a total of at least 60 documented experience points complying with R162-2f-401a. Experience points tables 1 & 2 are found in R162-2f-501, appendices.

- Complete and pass 120 hours of approved education at a certified Real Estate Pre-License School, consisting of:

- Part 1 Utah Law 30 Hours, including 3 hours testing

- Part 2 Broker Principles (Fundamentals) 45 Hours, including 4 hours of testing

- Part 3 Broker Practices (Broker Level) 45 Hours, including 4 hours of testing

- Take and pass the Broker Exam from State Approved Testing Vendor.

- Submit application to the Division and Include the checklist to ensure a complete application.:

- Checklist

- Completed and signed application (issued at the testing center).

- Signed original school certificates (issued by the real estate school) or Education Waiver (issued by the Division).

- Signed and Notarized Broker Experience Documentation Form showing at least three years of qualifying experience.

- Completed and signed Broker Transaction Log or Broker Property Management Log showing at least 60 experience points within the five years proceeding application.

- Signed and notarized Broker Verification Form completed by each Broker with whom the applicant has affiliated during the five years proceeding application.

Note: Forms must be submitted in a sealed envelope with the broker's signature across the seal. - For Principal and Branch Brokers, a notarized letter on the company’s letterhead, signed by a company Officer, Manager/Member or Owner, authorizing the Broker to use the company name.

- Two fingerprint cards (Blue FD-258) or receipt of digital fingerprints submission.

- $163 total non-refundable fee ($100 application fee, $18 recovery fund fee, $40 fingerprint processing fee and $5 rap back fee).

- Completed Certification of Legal Presence

Note: Incomplete applications will be returned to the applicant. Application fees are non refundable.

Reciprocity Agreement

NOTE: If you are licensed in another state you may obtain a Utah license either through reciprocity or by qualifying for an education waiver.

Utah currently has reciprocity agreements with Georgia, Mississippi, and Alberta Canada. Applicants with an active Real Estate license in good standing from a state that has a reciprocity agreement with Utah should submit to the Division:

- Completed and signed Real Estate Reciprocity Application .

- Original and certified license history (no more than six months old) from the jurisdiction where you are actively licensed and which has a reciprocity agreement with Utah.

- Original and certified license histories (no more than six months old) from all other jurisdictions where you have previously held a Real Estate license.

- For Principal and Branch Brokers, a notarized letter on the company’s letterhead, signed by a company Officer, Manager/Member or Owner, authorizing the Broker to use the company name.

- Two fingerprint cards and a signed Fingerprint Waiver (cards may be obtained from the Division or a local police station).

- For a sales agent, $157 total non-refundable fee ($100 application fee, $12 recovery fund fee, $40 fingerprint processing fee and $5 rap back fee).

- For a broker, $163 total non-refundable fee ($100 application fee, $18 recovery fund fee, $40 fingerprint processing fee and $5 rap back fee).

- Completed Certification of Legal Presence.

Applicants with an active real estate license in good standing from a state that does NOT have a reciprocity agreement with Utah may qualify for a waiver of some education and/or national exam requirements.

Waivers will not be granted if the license has expired or is not in good standing.

To qualify for an education/national exam waiver and obtain a Utah Sales Agent or Broker license, an individual must:

-

Meet the statutory licensing qualifications of honesty, integrity, truthfulness, reputation, and competency. (Utah Code Annotated 61-2f)

Note: According to Administrative Rules R162-2f-201, an applicant does not qualify for a real estate license if he or she has any felony in the last five years (starting from the time of conviction/plea or completion of any jail/prison sentence) OR if the applicant has any misdemeanor involving fraud, misrepresentation, theft, or dishonesty within the last three years. - Be at least 18 years of age at the time of application.

- Have at minimum a High School diploma or its equivalent.

- Complete, sign and submit to the Division the Real Estate Education Waiver Request.

- Wait for the Education Waiver from the Division prior to taking any pre-license education and/or exam.

- Take any required pre-license education at a certified Pre-License Real Estate School.

- Take and pass either the Sales Agent exam or Broker exam (either both the state and national portions or only the state portion, as required).

-

Submit to the Division:

- Completed and signed application (issued at the testing center).

- Signed original Education Waiver (issued by the Division).

- For Principal and Branch Brokers, a notarized letter on the company’s letterhead, signed by a company Officer, Manager/Member or Owner, authorizing the Broker to use the company name.

- Two fingerprint cards (Blue FD-258) and a signed Fingerprint Waiver (issued at the testing center).

- For Sales Agents, $157 non-refundable fee ($100 application fee, $12 recovery fund fee, $40 fingerprint processing fee and $5 rap back fee).

- For Brokers, $163 total non-refundable fee ($100 application fee, $18 recovery fund fee, $40 fingerprint processing fee and $5 rap back fee).

- Completed Certification of Legal Presence

To register a Real Estate Company, submit to the Division:

- Completed and signed Real Estate Company/Branch Registration (Trust Account and Operating Account Documentation Requirements). This checklist must be included with the registration.

- A Change Card for the new Principal Broker.

- Register with the Utah Division of Corporations showing the company is current and in good standing.

- Notarized letter on the company's letterhead, signed by a company Officer, Manager/Member, or Owner, authorizing the Broker to use the company name. This is not needed if the Broker is the owner.

- Trust Account and Operating Account Documentation Requirements

- $200 non-refundable fee.

To register a Branch Office, submit to the Division:

- Completed and signed Real Estate Company/Branch Registration . This checklist must be included with the registration.

- A Change Card for the new Branch Broker.

- Documentation, less than 30 days old, from a Utah financial institution verifying a real estate trust account, including the entire account number, with the Branch Broker as signatory. The account must include the approved Division entity name and the words "Real Estate Trust Account." Example: Ajax Real Estate - Real Estate Trust Account (This can be the same trust account used by the main office.)

- Documentation, less than 30 days old, from a Utah financial institution verifying an operating account, including the entire account number. (This is not required if it is the same operating account used by the main office.)

- $200 non-refundable fee.

A Sales Agent or Broker license is required for any individual who, for another and for valuable consideration, engages in property management including advertising real estate for lease or rent, procuring prospective tenants or lessees, negotiating lease or rental terms, executing lease or rental agreements. A licensed Sales Agent and Associate Broker engaging in property management must be affiliated and supervised by a Principal Broker. The licensing requirement does not apply to an owner who manages his or her own property, an employee for one property owner, apartment managers who reside in the apartments at reduced rent, full-time salaried employees of a Homeowners Association, hotel or motel management, or management activities associated with rental accommodations for a period of less than 30 consecutive days.

Prior to opening a Real Estate Brokerage that desires to perform property management services, a Broker must submit to the Division:

- Completed and signed Real Estate Company/Branch Registration (Trust Account and Operating Account Documentation Requirements) along with this checklist .

- A Change Card for licensee affiliating with the Real Estate Company.

- Certificate of Existence from the Utah Division of Corporations showing the company is current and in good standing.

- Notarized letter on the company’s letterhead, signed by a company Officer, Manager/Member or Owner, authorizing the Broker to use the company name.

-

Documentation from a financial institution less than 30 days old verifying a property management trust account on which the Broker is a signatory.

Note: the Broker must have separate trust accounts for the property management transactions and for the real estate transactions. Click here for Trust Account and Operating Account Documenation Requirements. - $200 non-refundable fee.

For more Real Estate related information such as license renewals, forms, education resources, and more, please visit the Real Estate page here.

Apply for a Mortgage License

Please select the license type you are applying for:

How do I become a licensed Mortgage Loan Originator?

The mortgage licensing laws and regulations have changed to comply with the federally mandated SAFE Act. It is important that you closely follow these instructions to obtain a loan originator's license in Utah:

- Meet the statutory licensing qualifications of good moral character, competency, honesty, integrity, and truthfulness. (Utah Code Annotated §61-2c-203)

-

Meet the statutory minimum licensing qualifications as outlined in Title V Sec 1505 of the Safe Act, that include the following:

- The applicant has never had a loan originator license revoked in any governmental jurisdiction.

-

The applicant has not been convicted of, or pled guilty or nolo contendere to, a felony in a domestic, foreign, or military court--

- During the 7-year period preceding the date of the application for licensing and registration; or

- At any time preceding such date of application, if such felony involved an act of fraud, dishonesty, or a breach of trust, or money laundering.

- The applicant has demonstrated financial responsibility, character, and general fitness such as to command the confidence of the community and to warrant a determination that the loan originator will operate honestly, fairly, and efficiently within the purposes of this title.

- Be at least 18 years of age at the time of application.

- Create your personal record in NMLS. Please reference NMLS Quick Guides. You will need your NMLS identifier number to provide to course providers. This will also allow you to schedule your exams after completing your education.

- Take the education requirements that include 20 hours of NMLS-approved courses (3 hours federal law and regulations, 3 hours ethics (including fraud, consumer protection, and fair lending practies), 2 hours non-traditional mortgages, and 12 hours of electives); AND 15 hours of Utah-approved pre-licensing education through an approved provider. The Utah 15-hour education must be completed. This course expires one year after completion so you must apply for a license before it expires.

- You must take and pass the NMLS national exam, including the Uniform State Test (UST) component.

- After passing both exams, complete the MU4 Form (Individual Record) in NMLS. This is your application for licensure. The company you are affiliating with will need to sponsor you for an approved (active) license. If you do not have a sponsor, your license will be in an inactive status until you have an employer sponsorship.

- Pay all licensing fees as assessed in NMLS.

- After requesting the license through NMLS, a copy of the certificate for completing the 15-hour Utah prelicensing course to the Division.

You must become a licensed Lending Manager to serve as a Principal Lending Manager for an entity or dba or a Branch Lending Manager for a branch. You can also obtain a Lending Manager license and leave it in an Associate Lending Manager status if you are not currently serving as either a Principal Lending Manager or a Branch Lending Manager for an entity. On NMLS your license will show only as a Lending Manager and the status will be determined by your position and tracked on the Division's records.

To become a Lending Manager you must meet the following requirements:

- Meet the minimum statutory licensing qualifications as outlined for a Mortgage Loan Originator.

- Carefully review qualifications to obtain the license as outlined by rule before proceeding to take the education and test.* You will need to validate this experience on the Lending Manager Experience Documentation form at the time of application.

Experience Documentation Form: There are three options to demonstrate your proficiency to pursue this license. Follow the requirements for the option you choose on the Lending Manager Qualification Application. Click to download form.

*It’s the applicant’s responsibility to review and verify their ability to meet the experience criteria to qualify for the Lending Manager license BEFORE proceeding to take the qualifying education and test. Applicant assumes all financial responsibility for the test and education and will subsequently need to have their Lending Manager experience verified by the Utah DRE, before qualifying for the license. ALL fees are non-refundable. - Take 40 hours of approved education from a certified Mortgage Pre-license School. Completion of your pre-licensing education must be verified by the provider on your Candidate Certifying Document and you must present the original document to the Pearson Vue Testing Center at the time of test administration.

- Take and pass the Lending Manager exam (and the NMLS national exam with UST component, if not already passed). The exam is given by Pearson Vue. You may contact Pearson Vue once you have completed your education to schedule your exam by calling 1-800-274-7292 or visit their website at home.pearsonvue.com/test-takers. Please see the Utah Lending Manager handbook for useful information on tesing.

- Request licensure through NMLS and pay associated fees within 5 days of passing the Lending Manager exam. Note: The Lending Manager exam score is good for 90 days, it can take more that 60 days to review and issue the license.

- Compile and submit the following information to the Division within 5 days of passing the exam:

- Completed Lending Manager checklist. (all documentation)

- Complete, sign, notarize and submit to the Division all required elements of the Lending Manager Experience Documentation Form

- Original 2 page application with a passing score on the Lending Manager exam and social security verification forms provided by testing center.

- Copy of paid invoice from NMLS showing proof of payment of Lending Manager license fee.

- Signed and stamped Education Certifying Document issued by education provider.

-

Supporting documentation to any "YES" answers from the MU4 Form in NMLS.

Incomplete submissions will be returned to the applicant

To obtain a license for a Mortgage Company or dba Company, you must create a registration on the NMLS website and complete an MU1 Form and the accompanying MU2 Form(s). There are procedures in NMLS to be followed as well as jurisdictional specific procedures for Utah. These are outlined in NMLS and summarized below:

- Each entity must submit a Certificate of Existence from the Utah Division of Corporations. This can be uploaded on your NMLS filing.

- Each entity must submit a notarized letter on company letterhead authorizing the Principal Lending Manager to use the company name.

- All trade names (dbas) must be listed in the Other Trade Name section on the MU1 Form for the company and a license filed.

- A license request must be made for all trade names (dbas) - "DRE Entity License Other Trade Name #(x)," in order to do business under that name in the state.

- A Certificate of Existtence from the Utah Division of Corporations must be uploaded to the MU1 filing for all trade names.

To register a Branch Office:

- File a Form MU3 through NMLS.

- A Form MU1 must be filed in NMLS for the Company before a branch filing can occur.

- A branch manager must be designated for each location and the branch manager must hold a Lending Manager license.

- The registration costs include the NMLS processing fee and the new application fee. All fees are payable through NMLS and are non-refundable.

- Once a request for licensure has been made in NMLS, the Utah Division of Real Estate will review for approval.

- All documentation must be submitted to the Utah Division of Real Estate within 5 days of the electronic submission of your application.

To change a Mortgage Company name:

After a company is registered on NMLS all name changes (and other amendments) will be processed in NMLS by amending the MU1 Form. The company must provide the following to the Division:

- Certificate of Existence from the Utah Division of Corporations showing the company is current and in good standing.

- Notarized letter on the company’s letterhead, signed by a company President or Owner, authorizing the PLM to use the company name.

To change a Mortgage Company owner:

Alll ownership changes must be submitted through NMLS on the MU1 Form.The following documentation will need to be submitted to the Utah Division of Real estate within 5 days of filing in NMLS:

- Certificate of Existence from the Utah Division of Corporations showing the new ownership and that the company is current and in good standing.

- Notarized letter on the company’s letterhead, signed by any new company President or Owner, authorizing the PLM to use the company name

To change the PLM for a Mortgage Company:

After the company is registered in NMLS, to change a PLM, you will need to amend the MU1 Form and the accompanying MU2 Form to show the new PLM as a Qualifying Individual for Utah. Submit to the Division a notarized letter on the company’s letterhead, signed by a company President or Owner, authorizing the PLM to use the company name. The new PLM will need to be sponsored by the company.

For more Mortgage related information such as license renewals, forms, education resources, and more, please visit the Mortgage page here.

Apply for an Appraisal License

Please select the license type you are applying for:

- Qualifications

- Appraiser Trainee

- Licensed Appraiser

- Certified Residential Appraiser

- Certified General Appraiser

- Appraiser Trainee Supervisor

- Appraiser CE Instructor

- Appraiser Pre-License Instructor

Qualifications

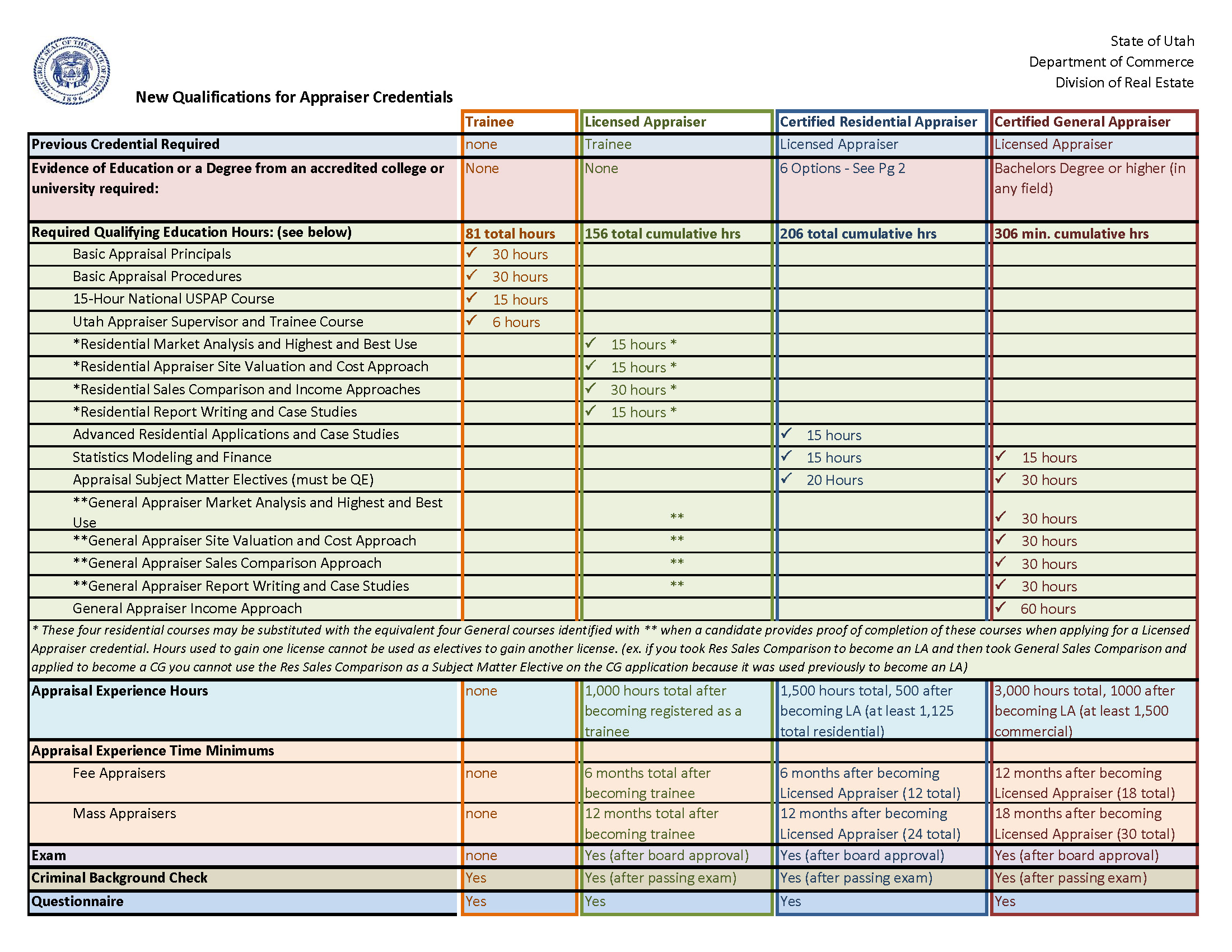

Please check the New Qualifications for Appraiser Credentials below.

Certified Residential College Requirement Options:

- Bachelor’s Degree, from an accredited college, in any field of study.

- Associates Degree, from an accredited college, in a Focused Field of Study (Business Administration; Accounting; Finance; Economics; or Real Estate).

- Successful Completion of 30 College Semester Credit Hours in ten, 3 semester hour courses, including: English Composition, Microeconomics, Macroeconomics, Finance, Algebra, Geometry, or Higher Mathematics, Statistics, Computer Science, Business or Real Estate Law, and two elective courses in: Accounting, Geography, Agricultural Economics, Business Management, or Real Estate.

- Successful Completion of College Level Examination Program (CLEP) Exams Equivalent to 30 Semester Hours including: College Algebra, College Composition, College Composition Modular, College Mathematics, Principles of Macroeconomics, Principles of Microeconomics, Introductory Business Law, and Computer Science.

- Any Combination of options #3 and #4 above That Includes All of The Topics Identified.

-

Experience "Opt Out" of College Requirements ONLY for Current Licensed Appraisers (if licensed for five (5) years), IF they also meet each of the following additional standards:

- No Disciplinary Action Affecting the License within five (5) years.

- Additional Appraisal (non College) Qualifying Education (50 Hours).

- 1,500 Hours of Experience.

- Passing the Certified Residential Exam.

Other Rules/State Requirements to remember:

- Experience hours toward Licensure are only recognized during the time when the individual was registered with the Division as a Trainee.

- Certified Residential Appraiser candidates must complete at least 500 experience hours, accummulated over at least 6 months during the time when the applicant is licensed as a State Licensed Appraiser.

- The Appraisal Board may not award credit for appraisal experience earned more than five years prior to the date of application.

- At least 50% of the appraisals submitted for experience credit shall be appraisals of properties located in Utah.

- Experience gained for work without a traditional client may qualify for experience hours but cannot exceed 50% of the total experience requirement.

- As to the first 35 residential appraisals or first 20 non-residential appraisals completed, as applicable to the license or certification being sought, the property inspection must include: - Measurement of the exterior of the property that is the subject of an appraisal; and - Inspection of the exterior of a property that is used as a comparable in an appraisal.

- An individual applying for certification as a Certified Residential Appraiser shall document at least 75% of the hours submitted from either the residential experience schedule (Appendix 1), or the mass appraisal schedule (Appendix 3).

- An individual applying for certification as a Certified General Appraiser shall document at least 1,500 experience hours from the general experience schedule (Appendix 2); or properties other than 1 – 4 unit residential properties identified in the mass appraisal schedule (Appendix 3).

- A maximum of 50% of required experience hours may be earned from appraisal of vacant land.

- Review appraisals shall be awarded experience credit when the appraiser performs technical reviews of appraisals prepared by employees, associates, or others, provided the appraiser complies with USPAP Standards Rule 3 when the appraiser is required to comply with the rule. The following credit shall be awarded for review of appraisals: desk review - 30% of the hours that would be awarded if a separate written review appraisal report were prepared, up to a maximum of 500 hours; and field review - 50% of the hours that would be awarded if a separate written review appraisal report were prepared, up to a maximum of 500 hours

Please see Rule R162-2g - Real Estate Appraiser Licensing and Certification Administrative Rules, for all rules and information.

To become an Appraiser Trainee an individual must:

-

Take 81 hours of required education from an approved education provider

- Find a Trainee Supervisor. Supervisor must be a Certified Residential Appraiser or General Appraiser who is licensed, active, has completed the Supervisory Appraiser and Appraiser Trainee Course, and is in good standing with the state of Utah. Please see detailed supervisor requirements by selecting the Appraiser Trainee Supervisor button at the top.

-

Complete all sections of the Appraisal Trainee Registration Packet . This checklist will help you in submitting a complete application and is included with your registration form. Include all of the following with your application:

- Checklist

- Appraiser Trainee Registration

- Appraiser Trainee Questionnaire

- Appraiser Education Log

- Education Certificates, including Supervisory Appraiser and Appraiser Trainee Course

- Two fingerprint cards

- Consent to Background Check

- Certificate of Legal Presence

- $145 non-refundable registration fee ($100 application fee, $40 fingerprint processing fee, and $5 RapBack fee)

To become a Licensed Appraiser an individual must:

-

Register with the Division as an Appraiser Trainee by completing the Appraiser Trainee Registration.

Note: Appraiser Trainees must work under the direct supervision of a Certified Appraiser. -

Take an additional 75 hours of required education (for a total of 150 non-duplicative hours) from our list of approved qualifying education providers & courses. Required courses are:

- Residential Market Analysis and Highest & Best Use - 15 hrs

- Residential Appraiser Site Valuation and Cost Approach - 15 hrs

- Residential Sales Comparison and Income Approaches - 30 hrs

- Residential Report Writing and Case Studies - 15 hrs

These 4 residential courses may be substituted with the equivalent 4 general courses:

- General Appraiser Market Analysis and Highest & Best Use - 15 hrs

- General Appraiser Site Valuation and Cost Approach - 15 hrs

- General Appraiser Sales Comparison Approach - 30 hrs

- General Appraiser Report Writing and Case Studies - 15 hrs

-

Accumulate a total of at least 1000 experience hours within six months to five years, while registered as a Trainee. Document experience on the following forms:

- Fee-Licensed Appraiser Experience Log (INSTRUCTIONS )

- Mass-License Appraiser Experience Log (INSTRUCTIONS )

Use these Experience Appendices Rules to determine the allowed number of hours for each completed appraisal.

Note: Residential Appraiser Trainees must be accompanied by their supervisor on the first 35 interior/exterior inspections. General Appraiser Trainees must be accompanied by their supervisor for the first 20 inspections.

-

Apply to sit for the Licensed Appraiser exam by submitting to the Division:

- Completed and signed Appraiser Application , including the application checklist

- Completed Certification of Legal Presence .

- Completed and signed Appraiser Education Log .

- Completed and signed Appraiser Experience Log as indicated above.

- $350 non-refundable fee.

-

Fee Appraisers

After your application has been reviewed, the Division will request, via email, 4 sample appraisals from your experience log. In addition to true copies of these appraisal reports the candidate must provide copies of the complete work file, which includes (but is not limited to) a verification source for each comparable that has been used; e.g., a copy of the MLS printout (if that is the source), a copy of the closing statement (or some other public record), and colored photos of the subject and all comparables.Mass Appraisers

At the time of application, Licensed Appraiser applicants whose experience is earned primarily through mass appraisal shall submit proof of having performed at least 65 hours of appraisals conforming to USPAP Standards 1 and 2; In addition to true copies of these appraisal reports the candidate must provide copies of the complete work file, which includes (but is not limited to) a verification source for each comparable that has been used; e.g., a copy of the MLS printout (if that is the source), a copy of the closing statement (or some other public record), and colored photos of the subject and all comparables.Please note that the confidentiality section of USPAP authorizes the disclosure of confidential information to state enforcement agencies. The reports you submit must not be altered in any way from the original format as submitted to your clients. Each appraisal must be signed by appropriate parties.

Use these Experience Appendices Rules to determine the allowed number of hours for each completed appraisal.

Note: Residential Appraiser Trainees must be accompanied by their supervisor on the first 35 interior/exterior inspections. General Appraiser Trainees must be accompanied by their supervisor for the first 20 inspections.

Upon receipt of written approval from the Appraisal Board, take and pass the Licensed Appraiser exam.

-

Upon passing the Licensed Appraiser exam, submit to the Division:

- Completed and signed documentation of successfully passing the exam (issued at the testing center).

- $125 non-refundable fee ($80 National Registry Fee, $40 Fingerprinting Fee, and $5 RapBack fee)

Note: Incomplete applications will be returned to the applicant.

Note: Licensed Appraisers may appraise non-complex 1-4 residential units with a value less than $1,000,000 and complex 1-4 residential units with a value less than $250,000.

Note: Note: This Experience Review Form will be used by our Experience Review Committee to determine if you meet the qualifications to take the national licensing exam.

To become a Certified Residential Appraiser an individual must:

Be an active Licensed Appraiser in good standing.

-

Take the additional 50 hours of approved education (for a total of 200 non-duplicative hours) from our list of approved qualifying education providers and courses. Required qualifying education courses are:

- Advanced Residential Applications and Case Studies - 15 hrs

- Statistics Modeling and Finance - 15 hrs

- Appraisal Subject Matter Electives - 15 hrs (This can be any approved qualifying education course that has not been used towards licensing previously. Course approval numbers start with an AQ)

-

Complete one of the following college requirement options:

- Bachelor’s Degree, from an accredited college, in any field of study

- Associates Degree, from an accredited college, in a Focused Field of Study (Business Administration; Accounting; Finance; Economics; or Real Estate)

- Successful Completion of 30 College Semester Credit Hours in ten, 3 semester hour courses, including: English Composition, Microeconomics, Macroeconomics, Finance, Algebra, Geometry, or Higher Mathematics, Statistics, Computer Science, Business or Real Estate Law, and two elective courses in: Accounting, Geography, Agricultural Economics, Business Management, or Real Estate

- Successful Completion of College Level Examination Program (CLEP) Exams Equivalent to 30 Semester Hours including: College Algebra, College Composition, College Composition Modular, College Mathematics, Principles of Macroeconomics, Principles of Microeconomics, Introductory Business Law, and Computer Science

- Any Combination of options #3 and #4 above That Includes All of The Topics Identified

- Experience "Opt Out" of College Requirements ONLY for Current Licensed Appraisers if licensed for five (5) years. (No Disciplinary Action Affecting the License within five (5) years)

-

Accumulate an additional 500 experience hours after becoming a Licensed Appraiser (for a total of 1500 experience hours) and have a minimum of 12 months work experience (six months after becoming Licensed Appraiser). Mass appraisers must have minimum of 24 months of work experience (twelve months after becoming Licensed Appraiser). Document experience on the following forms:

- Fee-Certified Residential Experience Log (INSTRUCTIONS )

- Mass-Certified Residential Experience Log (INSTRUCTIONS )

Use these Experience Appendices Rules to determine the allowed number of hours for each completed appraisal.

Note: At least 1125 experience hours must be residential.

-

Apply to sit for the Certified Residential Appraiser exam by submitting to the Division the following items along with the checklist :

- Completed and signed Appraiser Application , including Certification of Legal Presence .

- Completed and signed Appraiser Education Log .

- Official, original college transcript (Unless Licensed Appraiser for 5 years).

- Completed and signed Appraiser Experience Log as indicated above.

- $350 non-refundable fee.

-

Fee Appraisers

After your application has been reviewed, the Division will request, via email, 4 sample appraisals from your experience log. In addition to true copies of these appraisal reports the candidate must provide copies of the complete work file, which includes (but is not limited to) a verification source for each comparable that has been used; e.g., a copy of the MLS printout (if that is the source), a copy of the closing statement (or some other public record), and colored photos of the subject and all comparables.Mass Appraisers

At the time of application, Certified Residential Appraiser applicants whose experience is earned primarily through mass appraisal shall submit proof of having performed at least 110 hours of residential appraisals conforming USPAP Standards 1 and 2; and including two of each of the following property types:- vacant residential or agricultural land;

- two- to four-unit dwelling;

- single-family unit; and

- complex one to four unit residential dewllings;

In addition to true copies of these appraisal reports the candidate must provide copies of the complete work file, which includes (but is not limited to) a verification source for each comparable that has been used; e.g., a copy of the MLS printout (if that is the source), a copy of the closing statement (or some other public record), and colored photos of the subject and all comparables.

Please note that the confidentiality section of USPAP authorizes the disclosure of confidential information to state enforcement agencies. The reports you submit must not be altered in any way from the original format as submitted to your clients. Each appraisal must be signed by appropriate parties.

- Upon receipt of written approval from the Appraisal Board, take and pass the Certified Residential Appraiser exam.

-

After completing the exam, submit to the Division:

- Completed and signed documentation of successfully passing the exam (issued at the testing center).

- $125 non-refundable fee ($80 National Registry Fee and $40 Fingerprint Processing Fee and $5 Rap back fee)

Note: Incomplete applications will be returned to the applicant.

Note: Certified Residential Appraisers may appraiser 1-4 residential units of any value or complexity but may not appraise subdivisions for which a development analysis/appraisal is necessary.

Note: Note: This Experience Review Form will be used by our Experience Review Committee to determine if you meet the qualifications to take the national licensing exam.

To become a Certified General Appraiser an individual must:

- Be an active Licensed Appraiser or Certified Residential Appraiser in good standing.

-

Take an additional 100 hours of required education (for a total of 300 non-duplicative hours) from an approved education provider and a bachelor's degree or equivalent from an accredited college or university. Required qualifying education courses are:

- General Appraiser Market Analysis and Highest and Best Use (30 hrs)

- General Appraiser Site Valuation and Cost Approach (30 hrs)

- General Appraiser Sales Comparison Approach (30 hrs)

- General Appraiser Report Writing and Case Studies (30 hrs)

- General Appraiser Income Approach (60 hrs)

-

Accumulate an additional 2000 experience hours after becoming a Licensed Appraiser (for a total of 3000 experience hours) and have a minimum of 18 months work experience (12 months after becoming Licensed Appraiser). Mass appraisers must have a minimum of 24 months of work experience (18 months after becoming Licensed Appraiser). Document experience on the following forms:

- Fee-Certified General Experience Log (INSTRUCTIONS )

- Mass-Certified General Experience Log (INSTRUCTIONS )

Use these Experience Appendices Rules to determine the allowed number of hours for each completed appraisal.

Note: At least 1500 experience hours must be non-residential.

Apply to sit for the Certified General Appraiser exam by submitting to the Division the following items along with this checklist :

- Completed and signed Appraiser Application , along with Certification of Legal Presence .

- Completed and signed Appraiser Education Log .

- Official, original college transcript (Bachelor's degree or higher)

- Completed and signed Appraiser Experience Log as indicated above.

- $350 non-refundable fee.

-

Fee Appraisers

After your application has been reviewed, the Division will request, via email, 4 sample appraisals from your experience log. In addition to true copies of these appraisal reports the candidate must provide copies of the complete work file, which includes (but is not limited to) a verification source for each comparable that has been used; e.g., a copy of the MLS printout (if that is the source), a copy of the closing statement (or some other public record), and colored photos of the subject and all comparables.Mass Appraisers

At the time of application, Certified General Appraiser applicants whose experience is earned primarily through mass appraisal shall submit proof of having performed at least 300 hours of appraisals from Appendix 2 conforming to USPAP Standards 1 and 2. In addition to true copies of these appraisal reports the candidate must provide copies of the complete work file, which includes (but is not limited to) a verification source for each comparable that has been used; e.g., a copy of the MLS printout (if that is the source), a copy of the closing statement (or some other public record), and colored photos of the subject and all comparables.Please note that the confidentiality section of USPAP authorizes the disclosure of confidential information to state enforcement agencies. The reports you submit must not be altered in any way from the original format as submitted to your clients. Each appraisal must be signed by appropriate parties.

Upon receipt of written approval from the Appraisal Board, take and pass the Certified General Appraiser exam.

-

After passing the exam, submit to the Division:

- Completed and signed documentation of successfully passing the exam (issued at the testing center).

- $125 non-refundable fee ($80 National Registry fee, $40 Fingerprint Processing fee, and $5 RapBack fee).

Note: Incomplete applications will be returned to the applicant.

Note: Certified General Appraisers may appraise all types of real estate in Utah.

Note: Note: This Experience Review Form will be used by our Experience Review Committee to determine if you meet the qualifications to take the national licensing exam.

How do I become an Appraiser Trainee Supervisor?

Meet and understand criteria below and register via Trainee Appraiser Application.

Supervisory Appraisers provide a critical role in the mentoring, training, and development of future valuation professionals.

Roles And Requirements:

-

Supervisory Appraisers shall be responsible for the training, guidance, and direct supervision of the Trainee Appraiser by:

- Accepting responsibility for the appraisal by signing and certifying the appraisal complies with USPAP;

- Reviewing and signing the Trainee Appraiser appraisal report(s); and

- Personally inspecting each appraised property with the Trainee Appraiser until the Supervisory Appraiser determines the Trainee Appraiser is competent to inspect the property, in accordance with the COMPETENCY RULE of USPAP for the property type. Utah Administrative Rule requires that Supervisory Appraisers personally inspect a minimum of 35 residential and/or 20 commercial properties with each Trainee.

-

Supervisory Appraisers shall be state-certified and in “good standing for a period of at least three (3) years prior to being eligible to become a Supervisory Appraiser. Supervisory Appraisers do not need to be state certified and in good standing in the jurisdiction in which the Trainee Appraiser practices for any specific minimum period of time. Supervisory Appraisers shall not have been subject to any disciplinary action—within any jurisdiction—within the last three (3) years that affected the Supervisory Appraiser’s legal eligibility to engage in appraisal practice. A Supervisory Appraiser subject to a disciplinary action would be considered to be in “good standing” three (3) years after the successful completion/termination of the sanction imposed against the appraiser.

-

Supervisory Appraisers must comply with the COMPETENCY RULE of USPAP for the property type and geographic location where the Trainee Appraiser is being supervised.

-

Whereas a Trainee Appraiser is permitted to have more than one Supervisory Appraiser, Supervisory Appraisers may not supervise more than three (3) Trainee Appraisers at one time.

-

An appraisal experience log shall be maintained jointly by the Supervisory Appraiser and the Trainee Appraiser. It is the responsibility of both the Supervisory Appraiser and Trainee Appraiser to ensure the experience log is accurate, current, and complies with the requirements of the Trainee Appraiser’s credentialing jurisdiction. At a minimum, the appraisal log requirements shall include:

- Type of property;

- Date of report;

- Address of appraised property;

- Description of work performed by the Trainee Appraiser and the scope of the review and supervision of the Supervisory Appraiser;

- Number of actual work hours by the Trainee Appraiser on the assignment; and

- The signature and state certification number of the Supervisory Appraiser. Separate appraisal logs shall be maintained for each Supervisory Appraiser, if applicable.

-

Supervisory Appraisers shall be required to complete a 6-Hour Utah specific course which is specifically oriented to the requirements and responsibilities of Supervisory Appraisers and Trainee Appraisers in Utah. The course is to be completed by the Supervisory Appraiser prior to supervising a Trainee Appraiser.

PLEASE NOTE: You must notify the Division of Real Estate with any addition or removal of Appraiser Trainees.

For more Appraisal related information such as license renewals, forms, education resources, and more, please visit the Appraisal page here.